Morning Market Notes 01-10-25

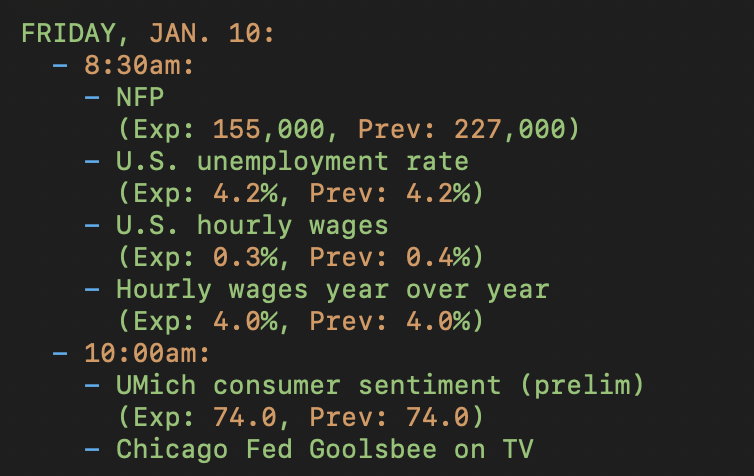

Market Calendar

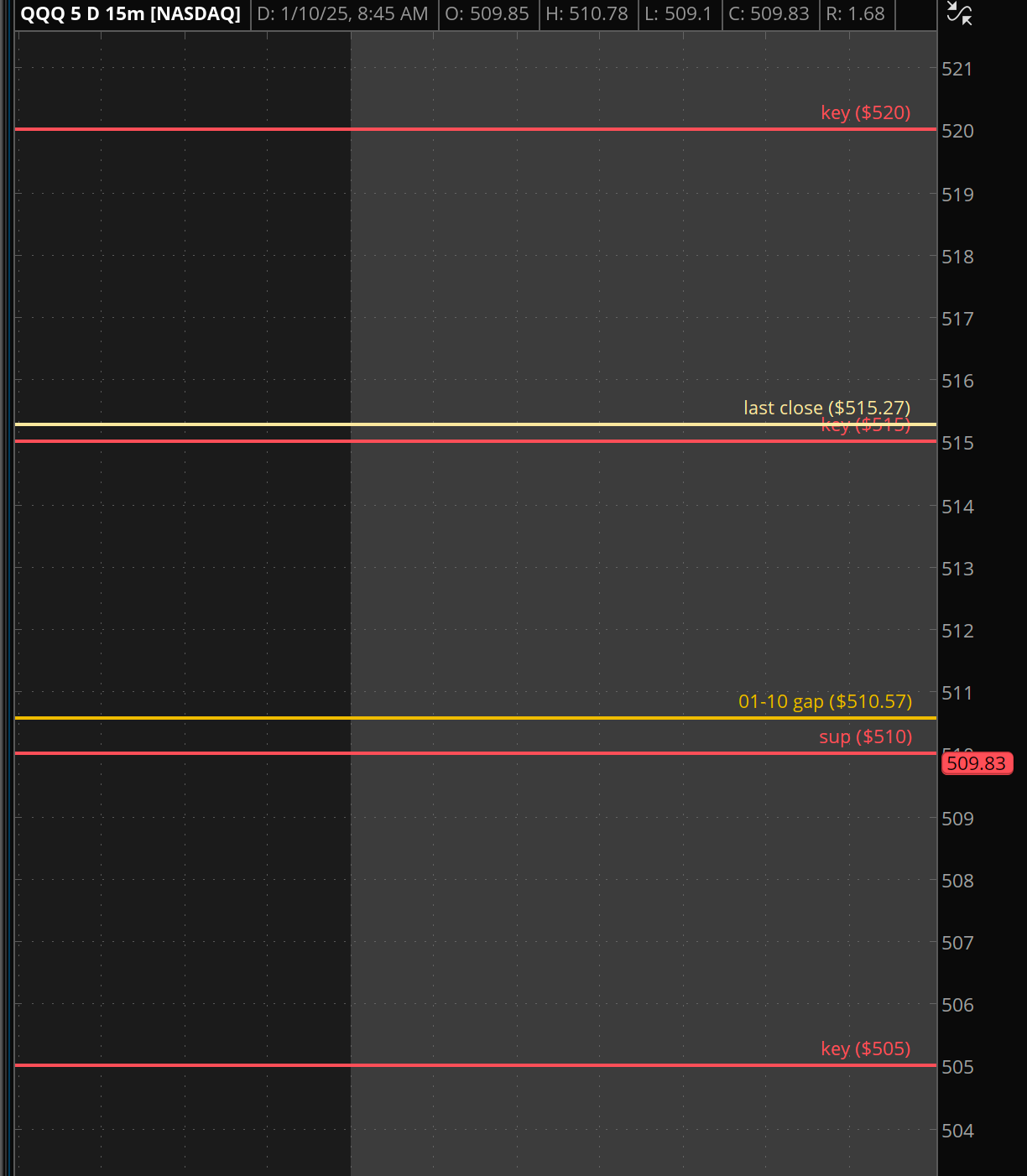

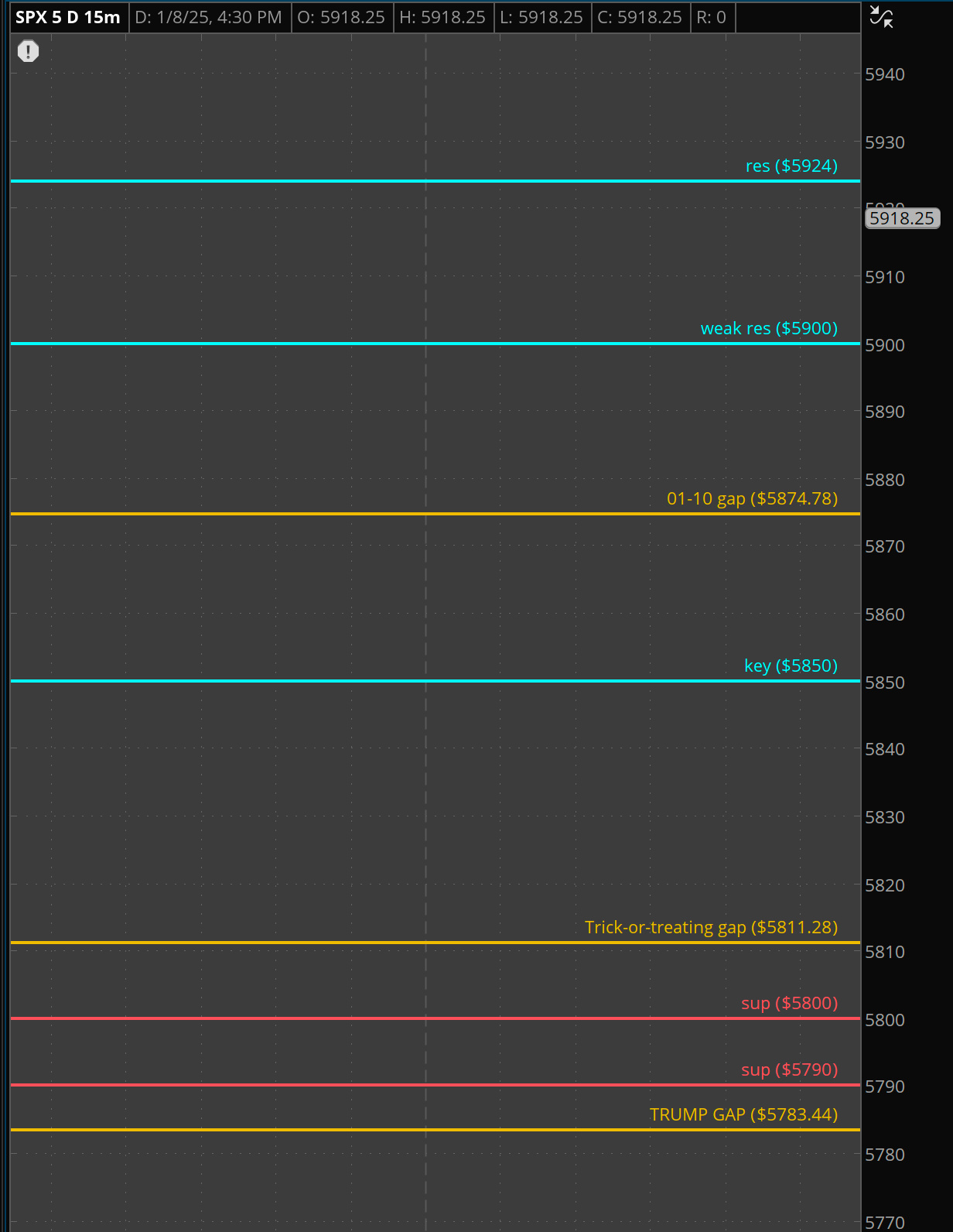

$SPX & $QQQ

$QQQ & $SPX 01-10 levels

An old-fashioned reaction to the Non-Farm Payroll data led to a ~60-point drop on $ES_F—enough to trigger the good ole unc2.0 system.

We’re implied to open below 5900 on $SPX, which fuels the downside. As experienced traders, betting on a direction isn’t sound in this environment. Instead, a possible strangle opportunity might be the way to capture any large moves that remain.

If the S&P fails to recover 5900, testing the next major support at 5800 and touching those open gaps below could be on the table.

Let’s have a sesh.

🚀 Don’t Miss Out: 0DTHERO Is Live

0DTHERO is the ultimate trading companion platform designed for Options and Futures traders. With real-time options flow, actionable insights, an intuitive dashboard, and a discord community, it’s everything you need to trade smarter.

👉 Join today with a 7-day free trial and use the discount code SAVAGE for 25% off your first month.