Morning Market Notes 01-14-25

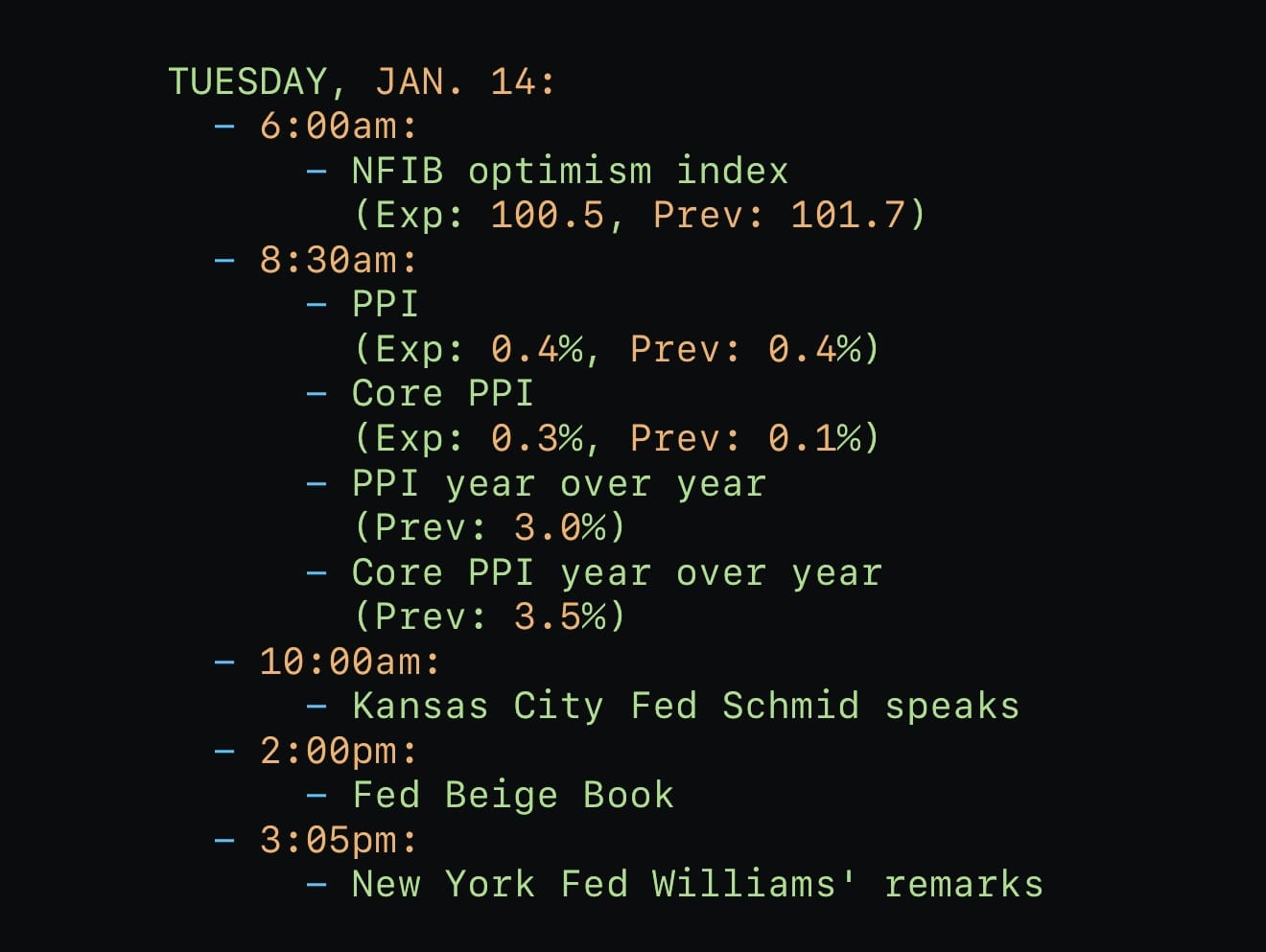

Market Calendar

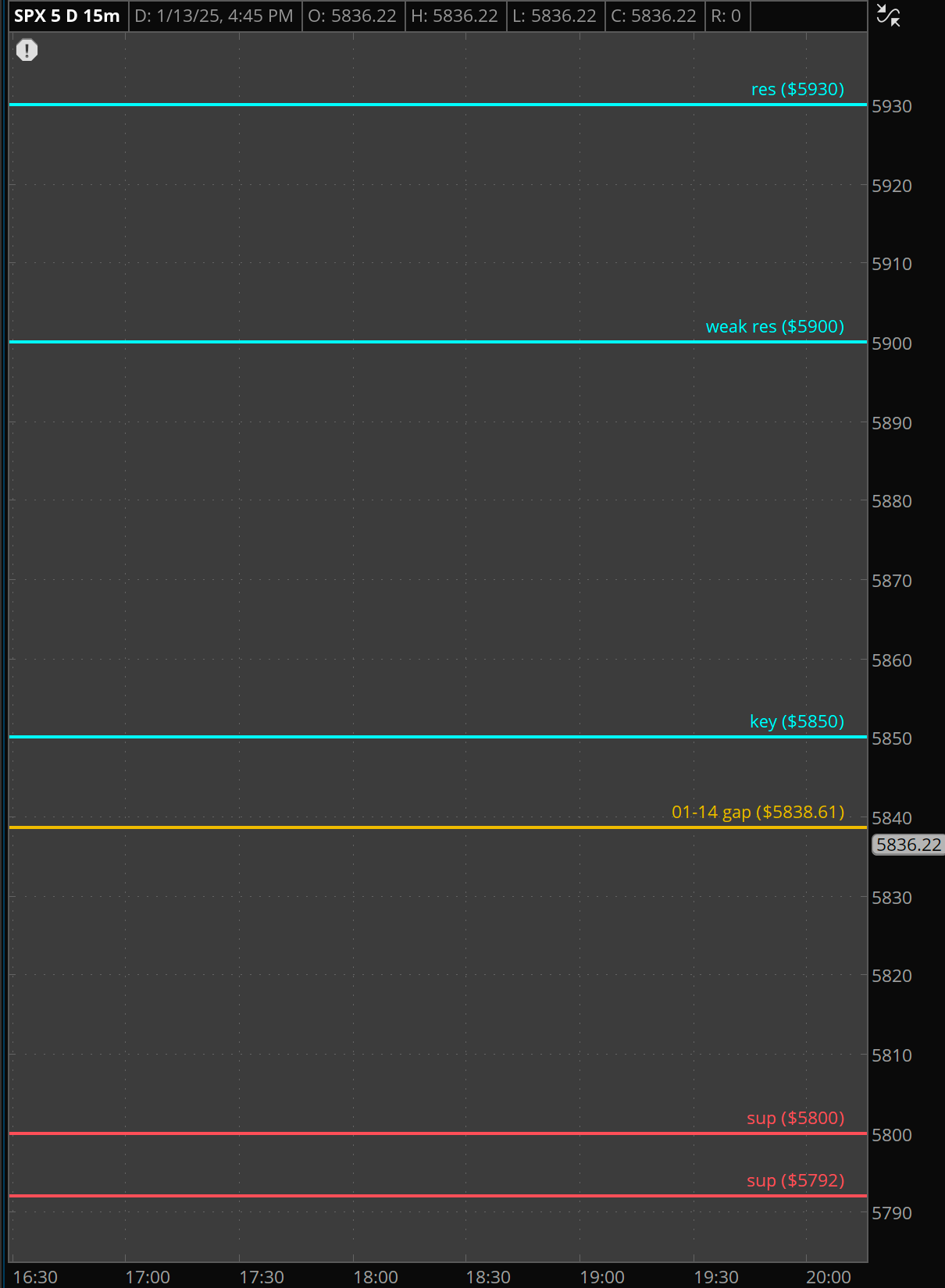

$SPX & $QQQ

$QQQ & $SPX 01-14 levels

The PPI print came slightly below expectations, triggering a beautiful 40+ point green candle on $ES_F. The implied move for the day sits above 1%, which aligns with the options landscape and flows.

In our notes yesterday, I mentioned that upside was likely above 5800 $SPX. This proved true, as $SPX is now implied to open above 5850.

Per 0DTHERO, the call wall on $SPX moved down yesterday, which isn’t a bullish signal. This means that a rally here, unless supported by continued favorable CPI data tomorrow, is most likely a dead cat bounce.

We’ll watch for a potential trend pattern with UME today, as this could turn into one of those CPI-eve sessions packed with fuel for trends or violent price swings. Both scenarios are excellent for options and futures trading.

Let’s have a sesh.

🚀 Don’t Miss Out: 0DTHERO Is Live

0DTHERO is the ultimate trading companion platform designed for Options and Futures traders. With real-time options flow, actionable insights, an intuitive dashboard, and a discord community, it’s everything you need to trade smarter.

👉 Join today with a 7-day free trial and use the discount code SAVAGE for 25% off your first month.